Data centers hum with the electricity that powers our digital lives, from streaming movies to online shopping and beyond. But where are these powerhouses concentrated? Which cities and regions are the biggest guzzlers of data center energy?

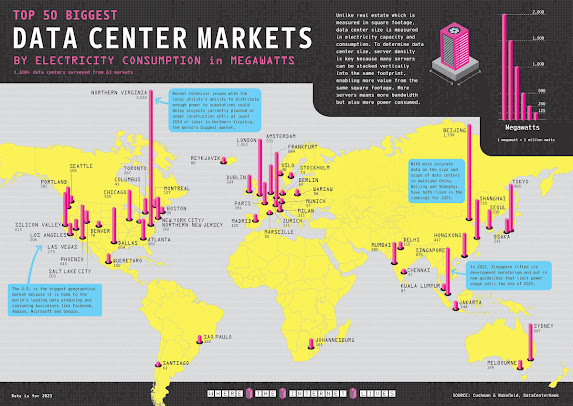

This bar chart highlights the dominance of Northern Virginia and Beijing, followed by a cluster of major metropolitan centers vying for data center supremacy.

Let's dive into the ranking of the top 50 data center markets by power consumption, along with insights and visualizations to illuminate the global landscape of this critical infrastructure.

Top 5 Power Hogs:

Northern Virginia, USA: Unsurprisingly, the crown jewel of the data center world, Northern Virginia, reigns supreme with a whopping 2,552 MW of capacity. Home to tech giants like Amazon Web Services and Microsoft Azure, this region alone handles over a third of global online traffic.

Beijing, China: Following closely behind is the Chinese capital, Beijing, with a measured capacity of 1,799 MW. China's rapid digital growth fuels the demand for data centers, and Beijing remains a key hub for both domestic and international players.

London, UK: Europe's data center crown jewel, London, boasts a capacity of 1,053 MW. Its strategic location, robust connectivity, and mature regulatory environment make it a prime destination for hyperscalers and enterprises alike.

Singapore: This Southeast Asian island nation punches above its weight in the data center game, with a capacity of 876 MW. Singapore's stable government, efficient infrastructure, and tax incentives attract major tech players seeking access to the growing Asian market.

Tokyo, Japan: Rounding out the top 5 is Tokyo, with a capacity of 726 MW. As the economic and technological powerhouse of Japan, Tokyo serves as a crucial data center hub for the region.

The remaining 45 markets on the list showcase the global spread of data center activity. Emerging markets like India, Brazil, and Indonesia are seeing rapid growth, fueled by increasing internet penetration and cloud adoption. Meanwhile, established markets like Frankfurt, Amsterdam, and Paris continue to attract investment due to their reliable infrastructure and access to skilled talent.

India's Rise in the Data Center Arena:

While currently ranked 13th globally in terms of power consumption, India's data center market is experiencing explosive growth. From a capacity of 370 MW in 2018, it's estimated to reach 1,318 MW by 2024, representing a remarkable 256% increase in just six years. This surge is driven by several factors:

Digital Explosion: India boasts over 500 million internet users, a number projected to reach 850 million by 2025. This massive digital population fuels the demand for data storage and processing power.

Cloud Adoption: Indian businesses are rapidly migrating to the cloud, accelerating the need for robust data center infrastructure.

Government Initiatives: Recognizing the industry's potential, the Indian government has rolled out incentives like reduced taxes and simplified approvals to attract data center investments.

Strategic Location: India's central geographic position makes it an ideal hub for serving markets across Asia, Europe, and Africa.

India's Impact on the Global Landscape:

As India's data center market matures, it will significantly impact the global landscape:

Shifting Power Dynamics: India's rapid growth may reshape the top rankings in the future, potentially challenging established players like Northern Virginia and Beijing.

Diversification: India's unique market characteristics and regulatory environment will introduce further nuance and complexity to the global data center ecosystem.

Focus on Sustainable Solutions: India faces unique challenges like high energy costs and environmental concerns. Its efforts to develop energy-efficient and sustainable data center solutions can hold valuable lessons for the entire industry.

Beyond the Data:

The growth of India's data center industry goes beyond mere numbers. It signifies the country's increasing participation in the global digital economy, creating new jobs, fostering innovation, and supporting the development of critical digital infrastructure.

Looking Ahead:

India's data center industry holds immense potential, and its future trajectory will be shaped by:

Continued government support: Sustained policy support and regulatory clarity will be crucial for attracting further investment.

Technological advancements: India needs to keep pace with global advancements in cooling technologies, renewable energy integration, and artificial intelligence-powered data center management.

Skilled workforce development: Building a skilled workforce capable of managing and maintaining complex data center infrastructure is essential.

Sources:

Visual Capitalist: Ranked: Top 50 Data Center Markets by Power Consumption

Cushman & Wakefield: Global Data Center Market Comparison

CBRE: Global Data Center Trends 2023

Mordor Intelligence: India Data Center Market Size, Growth & Industry Report

India Briefing: India's Data Center Sector: Market Outlook and Regulatory Frameworks

Comments

Post a Comment